By: Rocheford T. Gardiner |Contributing Writer

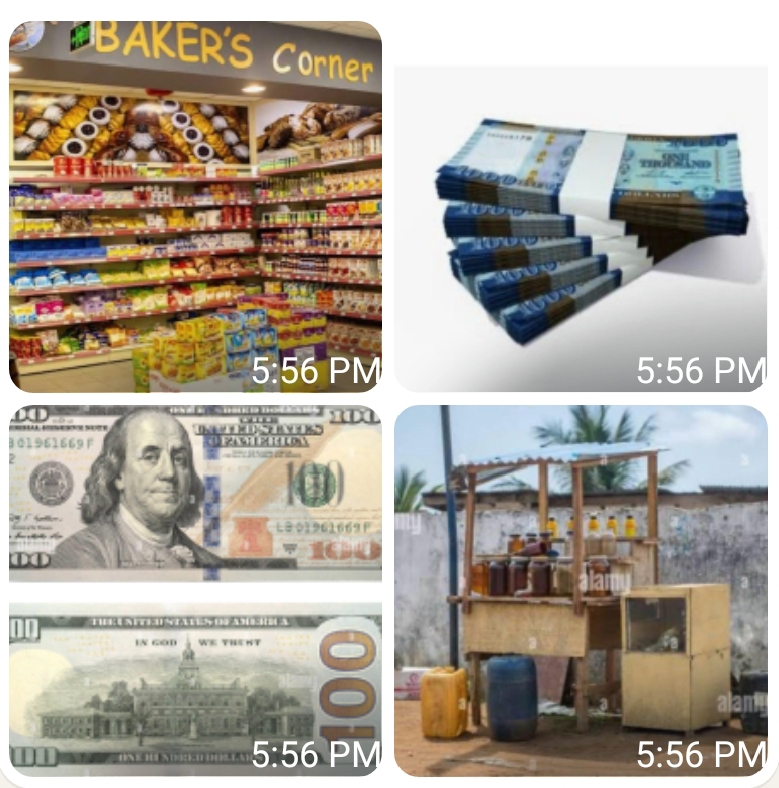

For more than three months, the Liberian dollar (LRD) has experienced a significant and sudden appreciation, gaining approximately 25% of its value against the US dollar (USD). This abrupt shift has caught many market players by surprise.

Before October 2025, the exchange rate stood at roughly $LRD 200.00 for every $USD 1.00. By November, the situation had shifted dramatically, with the rate moving to $LRD 175.00 for every $USD 1.00. Following this change, there was a general market expectation that businesses, both wholesalers and retailers, would need time to clear old, higher-priced stock before proportional price adjustments could take effect.

A Mixed Picture for Consumers

This adjustment has been evident in the price of rice, Liberia’s staple commodity. Far-off regions, such as Maryland County, have seen price reductions of up to 40%. A 25kg bag of rice is now retailing for a maximum of $LRD 3,000, and can even be found for as low as $LRD 2,900. This is a welcome change compared to two years ago, when the same bag sold for $LRD 5,000.

However, the picture is different for other essential local commodities. Items like cooking oil and sugar have seen little to no corresponding price reduction. Even more confusingly, petroleum products have seen a sudden shortage and a subsequent increase in pump prices.

This increase is difficult to justify from an economic standpoint: the foreign exchange rate is lowering, the wholesale price in Monrovia remains constant, and road conditions are generally good, which should keep transit costs stable.

The Official Stance: Policy vs. Speculation

The economic contradiction between a strong Liberian dollar and rising local prices has not gone unnoticed by authorities. The Central Bank of Liberia (CBL) confirms the LRD’s appreciation is genuine, attributing the stability to sound monetary policy and strong remittance inflows. The CBL has repeatedly asserted there is no liquidity shortage and that high prices are primarily fueled by “speculation, hoarding, and misinterpretation” of market conditions.

This official stance is met with deep public frustration. As Moibah Barwoh, a Branch Manager at a local bank, put it: “I think the business people are just up to their own thing—they control the local market to a large extent. I don’t even understand what’s going on—the Central Bank has not made any changes and there should be no reason for any increment.”

Furthermore, the Liberian Senate has summoned officials from the Ministry of Commerce and Industry (MoCI) and the CBL to explain the persistent surge, specifically accusing the MoCI of failing to regulate and control commodity prices.

For instance, the controversy over fuel prices is evident in the government’s transfer of import control to the state-owned Liberia Petroleum Refining Company (LPRC) to stabilize supply—an intervention necessitated by frequent price spikes. While wholesalers claim the pump price increment (from $LRD 800 to $LRD 900) is due to “clearing of old stocks,” this explanation defies standard global commercial practices, where suppliers typically reduce prices to clear old inventory. Instead, this phenomenon is widely seen by officials as “price stickiness”—the deliberate failure of vendors to pass along macroeconomic gains to consumers.

Consumers Left to Fend for Themselves

The lack of consistent regulatory oversight remains a defining feature of this market anomaly. Local authorities are often silent or ineffective on these matters, leaving ordinary consumers to “sort things out for themselves.” They remain at the mercy of business operators who, despite favorable macroeconomic indicators, appear to be dictating rules and prices at will.

10 Comments

Had a quick experience over at jilicrovn, it’s looking alright so far. Initial impressions are positive. See for yourself here: jilicrovn

читать Отдыхай. Наслаждайся. Живи.

I regard something genuinely interesting about your website so I saved to fav.

Another way to bypass 188bet’s access trouble: cachvao188bet.org. If you are still having issue, give this link a shot: cachvao188bet!

Alright, check out 9apisoph if you’re looking for something a bit different. Not my usual cup of tea, but someone might find it interesting. Have a look: 9apisoph

Thank you for the sensible critique. Me and my neighbor were just preparing to do some research about this. We got a grab a book from our area library but I think I learned more from this post. I am very glad to see such magnificent information being shared freely out there.

CasinoPlus with GCash? That’s convenient! Makes topping up and cashing out so much easier. Highly recommend! Visit: casinoplusgcash

With havin so much content do you ever run into any problems of plagorism or copyright infringement? My blog has a lot of exclusive content I’ve either created myself or outsourced but it appears a lot of it is popping it up all over the web without my permission. Do you know any methods to help prevent content from being stolen? I’d definitely appreciate it.

pin77 app https://www.pin77.tech

I think you have remarked some very interesting points, appreciate it for the post.